By Jakub Makurat, country manager for Poland, Czechia, Slovakia and the Baltics, Ebury

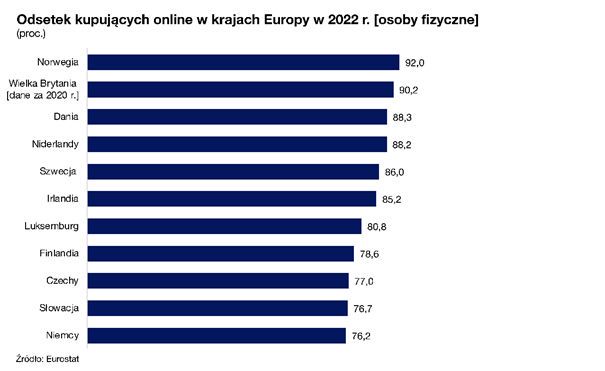

More than 90% of Britons shop online. This percentage is much higher than both the EU average (68%) and the Polish average (65%). On top of that, marketplace platforms are the biggest players in Britain. It’s hard to find better conditions to safely start and grow exports in the e-commerce channel. However, protecting margins can be a challenge – what should you pay attention to?

According to Ebury’s estimates, there are currently about 3,500 Polish entities registered on Amazon’s platform that carries out transactions worth more than €10,000 per month.

I mention this platform not without reason. Unlike in Poland, in the UK Amazon is not only the largest marketplace platform, but also the largest player in the entire e-commerce market. Therefore, those considering developing export and online sales (i.e. cross-border e-commerce) in the UK market should not underestimate this sales channel.

Promising e-commerce market

Brexit has somewhat halted the activity of exporters to the UK, including in e-commerce channels. Due to additional bureaucracy, many companies have focused their attention on other European markets.

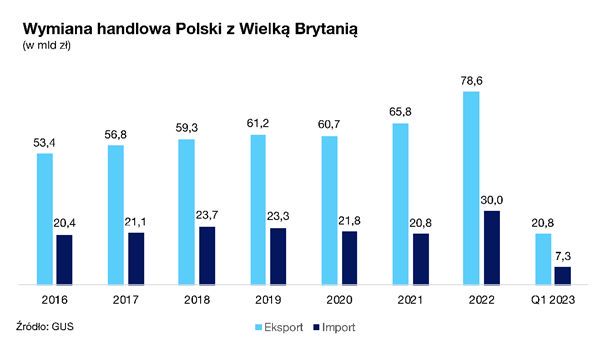

Nonetheless, it is also clear that Polish business has quickly returned to the game for British consumers. In Q1 2023 alone, the value of Poland’s exports of goods to the UK exceeded 20.7 billion złotys (up 12.6% year-on-year), and for the whole of 2022, 76.5 billion złotys (up 19.5% y/y). According to the Central Statistical Office, the UK ranks fourth among Poland’s export markets.

To maintain the upward trend, it’s worth developing sales precisely in the cross-border e-commerce model. Why? The UK remains a very promising market in this regard. This is borne out by the forecasts of analysts at Research and Markets, according to which the online trade (B2C) market in the UK will grow at a rate of 6.7% per year between 2023 and 2027.

According to the UK’s Office for National Statistics, the average weekly value of online retail purchases grew by about 4.7% from 2020 to 2022, while in April this year the average weekly online retail sales exceeded £2.3 billion (not including fuel sales).

The market of the demanding consumer

The Eurostat estimate, cited above, that more than 90% of Britons buy online proves that the market potential is huge. Especially when we realise that the country is one of the leaders in Europe in this regard.

On the other hand, however, customers in Britain value, above all, very good quality products. They also pay special attention to their design.

And this means that the key to success on the British market is not at all the mass sale of many products on Amazon. From our observations and conversations with entrepreneurs present on UK online commerce platforms, it seems that a much better strategy is to expand your offerings gradually and prudently. The first step should be a careful examination of whether the product will be noticed and appreciated by consumers. Such a strategy allows at least better control of logistics costs.

Freight transportation after Brexit. A warehouse is a must

Well-organised logistics is a prerequisite for the success of an exporter selling goods in the cross-border e-commerce model. As in Poland, consumers do not accept extended delivery times. In practice, this means that a Polish company should stock a warehouse in the UK and make deliveries to customers from there.

This is also important from the point of view of paperwork at the border. An entrepreneur should always take into account the risk of delays in customs and tax procedures – after Brexit, they have rules for exporting goods outside the EU.

Marketplace platforms such as Amazon offer Polish sellers space in their warehouses and take over the obligation to carry out deliveries. However, it is worth remembering that this is only one of the possible solutions. Exporters also practice renting space and making deliveries on their own, or a hybrid model, i.e. supplying a marketplace-managed warehouse from their own facility in the UK.

Each solution has its advantages and disadvantages related to continuous availability of products, rotation of goods or return policy. It is worth examining them carefully before starting to sell.

Selling goods on a UK marketplace? Pay attention to currency transactions

From my perspective, I can add that Polish companies that are developing exports to the UK through e-commerce channels should also pay special attention to the way they will carry out currency transactions. Thoughtful decisions in this regard will help them reduce costs and thus support business margins.

Our experience shows that there are many payment risks that businesses are not even aware of. What’s worth keeping in mind?

- Risk of GBP/PLN exchange rate fluctuations – exchange rate fluctuations do not allow you to accurately forecast revenues from sales expressed in pounds when converted to zlotys. So the strengthening of the Polish currency in this case is unfavourable for the Polish exporter.

- Liquidity risk – funds from a customer after selling a product on a marketplace platform do not immediately go to the seller’s account. They must first place an instruction to transfer the collected money, but usually cannot do so more often than once every two weeks. In this way, marketplace sites protect themselves in case of, for example, complaints or returns.

- Risk of double currency conversion – even if a Polish seller has a currency account and would like to receive funds from sales in pounds, for example, it is often not possible. This is due to the identification of currencies only by the national IBAN number (since the account in a Polish bank is preceded by the abbreviation PL, the transfer to the seller’s account is made in zlotys). The money is automatically converted twice: first to zlotys by the payment operator, and then by the bank to the currency in which the account is maintained – for example, back to pounds. Each time, the trader will incur spreads and, as a result, may lose up to several percent of the value of the goods sold. This significantly reduces their margin.

The trader can receive funds to an account maintained in zlotys, but then they still incur the cost of the spread applied by the marketplace on the GBP/PLN exchange rate.

Virtual IBAN – why it’s worth exploring this solution

The procedure for setting up a bank account in the UK – which would allow a company to receive receivables in pounds – requires a lot of time and going through a complicated procedure. For this reason, for many entities in the SME sector, the procedure is not even possible.

In Ebury, on the other hand, Polish exporters can set up an account in British pounds (or other foreign currencies) with a so-called virtual IBAN number. Such a solution allows to receive funds directly in pounds, avoiding the above-described problem of double conversion and high currency spreads. This is made possible by linking the customer’s account to an Ebury account held in the UK.

In this case, you can also count on faster transfer processing – the money is usually in your account the day after you place an order on the sales platform. This is a practical benefit from the companies’ perspective.

We also give exporters access to a range of tools to hedge against changes in the zloty/pound exchange rate, which in practice significantly reduces currency risk.

Knowledge of available settlement options, as well as in-depth market knowledge, is essential in building a business strategy and competitive position. It’s worth having them on hand when dealing with such a challenging yet promising market as the UK.

Ebury is a global payment institution with the status of an electronic money institution, with roots in the UK. It specialises in financial services for the SME sector and large enterprises. It effectively helps Polish companies manage foreign exchange risk and eliminates barriers to foreign exchange settlements and transactions. Ebury enables transactions for companies in more than 130 currencies, and maintains accounts for companies in local currencies in more than 20 countries.

SEE MORE: https://www.ebury.pl