- Executive Note

- Editorial note

- Interviews

- Finance and Financial Services

- Events Coverage

How to profit from inflation – a case study

Sherlock 7 | Jun 18, 2023, 20:42

By Marek Gołębiowski/sherlock7

The esteemed British banker, Nathan Rothschild, used to say that great fortunes are made when cannonballs fall in the harbour, not when violins play in the ballroom. We can all agree that Poland’s year-on-year inflation jump to 18.4% in February 2023 (compared to 2.4% in February 2021) is one of those moments when cannonballs fall in the harbour.

The purpose of this article is to show CEOs (and indeed potential CEOs) how to think about problems in general, not what to think. It is a strategic thinking masterclass in action. In order to achieve the above-mentioned purpose, you dear reader, will be asked to solve a case, and I will be looking over your shoulder in the process. Inflation is used as an example of a problem that you can easily relate to, in order to immerse yourself in the case. Let’s start.

The CEO of LendCo asks you to determine how his company may be negatively affected by inflation, and to recommend actions that will improve his company situation or at least lessen the negative impact of it.

What is the number one question you want to ask at this stage of a case? Think for few seconds. Let’s summarise what you know. You know from the name of a company ‘LendCo’ that its business is lending something, and that profits may be negatively affected. So, the question to ask is ‘How does LendCo make money?’

LendCo makes money by lending it to people with average and below average incomes. Okay, so you understand that LendCo is in a money business. What you may be curious about is how its customers are different from banking customers.

LendCo’s customers won’t get loans from banks, because they have lower, less predictable, and not well-enough documented incomes. Now, you may be wondering if LendCo is bonkers, but you want to double check, because you know that lending to customers with a riskier credit profile is possible given loans are over secured by some assets. Pawnshops do it, so it will be a valid hypothesis to check it out.

You learn from the CEO that loans the company offers to consumers aren’t secured by any assets whatsoever, and that LendCo isn’t a pawnshop. The CEO seems to be a little upset that you compared him to a pawnshop. The first question that pops into your mind is probably ‘How do they do it given they don’t secure risky loans?’

Our credit agents vet customers, lend and collect money from them on a weekly basis in the convenience of their homes, the CEO says. Now you see that LendCo approaches customers in a radically different manner, so they can lend where others can’t, because they have access to data other lenders simply don’t have. Credit agents make sense of customers’ circumstances at the exact place where they are created, to gauge whether they will pay loans back or not.

At this very moment you more or less understand what LendCo does. But, how do you move from understanding what it does to how it will be affected by inflation? You need to structure what LendCo does in a form of a model to enable you to observe by your own eyes how LendCo’s profitability will change due to a surge in inflation. How do you structure a model in our case? You need to ask how LendCo’s CEO measures profitability, or how similar companies do it.

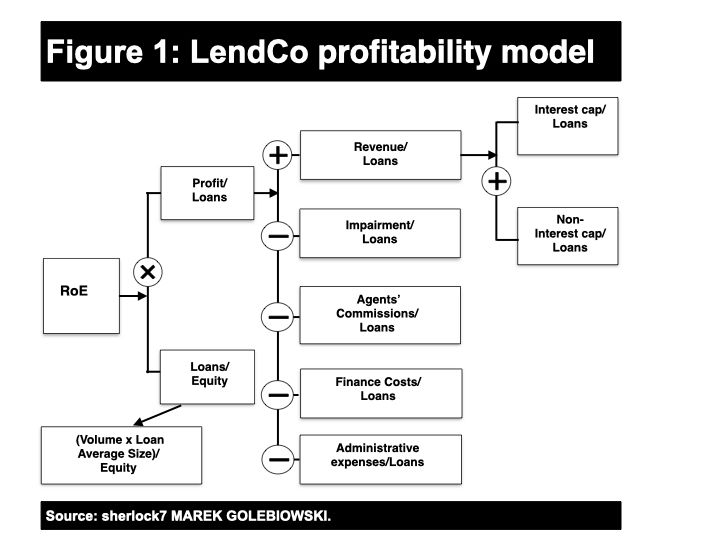

CEO tells you that they have an annual profitability goal of 20% return on equity they put in. Using this information may be daunting at first, until you understand that you need to break complexity into smaller manageable pieces that you can intuitively understand. So, 20% return on equity (RoE) is simply annual profits generated through a year divided by the average equity put into LendCo. Equity is nothing more than cash injected into a company. RoE is best broken down by a profit driver, which in LendCo’s case are loans, and by equity that provides part of cash (the rest is debt financed) to issue those profit-generating loans (See Figure 1).

Before analysing changes in profit, let’s dive into what loans are made of – the number of loans issued multiplied by the average size of a loan. Now you understand the model; we have arrived at something that will directly let us make conclusions about the changes that the surge in inflation makes to LendCo’s profitability from the ground level. If volume and/or average loan size spike with an unchanged level of equity while other parameters stay unchanged, then LendCo’s profitability will increase. The logical question to ask is whether volume or/and average loan size have changed, and if so, how – after customers have started feeling the effects of inflation.

LendCo’s CEO with a grim look on his face informs you that volume dropped by 20%, but average loan size went up by 25%. You’re curious. You ask why volume dropped while loan size surged…You make two hypotheses: (a) volume dropped as some customers weren’t able to afford loans even with the supportive touch of LendCo’s credit agents, because rising inflation decreased their disposable income available for loan repayments; (b) the average loan size went up, because the prices of the things and experiences LendCo’s customers borrow money for also went up.

Based on data provided by LendCo’s CEO, you can’t reject any of your suspicions (hypotheses); until additional data arrives you treat them as very probable explanations that can be used for further reasoning.

Do you remember the objective of the case? You need to not only find out how inflation affected LendCo’s profitability, but also recommend action to improve it.

You got the first part right: inflation decimated a significant number of customers, but it also increased average loan value. Based on your mental arithmetic skills, you calculated that the total loan value stayed unbothered, which is quite fortunate, given the cost-of-living crisis: 0.8 (-20% of volume) times 1.25 (+25% of average loan value) equals 1.

What concrete actions do you recommend to ease the cost-of-living crisis pressure on LendCo’s loan volume? Take a few minutes to think about this one really hard; don’t rush. Ask yourself the question: “What can be done to increase your potential customers’ disposable income, given it is a reason behind lagging borrowings?”

You may recommend directing LendCo’s offer more vividly towards customers who are eager to use borrowings to grow their micro-businesses or educate themselves in order to increase their odds for higher future incomes.

Knowing that the number of loans went down coupled with an increase in their average value begs the question whether those to whom loans were granted defaulted materially on their commitments.

LendCo’s CEO informs you that impairments as a percentage of loans granted haven’t changed. This is a very good news, because it shows that the method of credit vetting used by LendCo has proved itself in times of radical change of credit risk, which will be a strong foundation for growing the business in terms of volumes.

You maybe suspecting agents’ commissions have risen in relation to loans granted, given the level of vetting they provide; this proves to not be the case. Neither have administrative expenses changed in relations to value of loans granted.

What about financing costs in relation to loans? It’s natural that interest rates on capital markets surge in line with inflation, because of upward changes in central banks’ reference rates, and higher demanded returns on equity.

The CEO confirms your suspicion that financing cost went up, but not as dramatically as the inflation surge would suggest, because LendCo’s debt has substantially longer maturity in comparison to its loan portfolio.

What actions do you recommend to lower financing costs in percentage terms?

Acquiring a bank or getting a banking license in order to gather deposits directly from account holders at substantially lower costs versus dealing with seasoned banks, and capital market investors – are big moves that may work.

Last but not least – the huge impact inflation has had on regulatory moves. Given the cost-of-living crisis induced by increased price levels, regulators decided to cap interest and non-interest rate revenues in percentage terms on loans at lower levels than those before the inflation spike showed up.

What actions do you recommend to lessen restricted caps levels?

This is one of those situations where you can’t influence caps directly, but if interest and non-interest revenue start to be seen as a part of margin on financing costs, then substantial lowering of debt financing cost may recoup lost revenue charges.

What’s our final recommendation at this point?

LendCo should in the long-term:

(1) Focus on serving customers who will use borrowings to grow their micro-businesses, and educate themselves in order to increase their odds for higher future incomes.

(2) Investigate acquiring a bank or getting a banking licence to get access to more extensive financing at lower rates from bank’s accounts holders.

Good strategies, like pearls, are made as a natural defence against an irritant entering their habitat. Inflation is the irritant that we have together transformed into a pearl.